Cyber Insurance

Meet the customer identity & access management standards required to obtain cyber insurance.

Cyber insurance is coverage that protects organizations from financial losses associated with cyber incidents and data breaches.

Cyber insurance policies often include coverage for legal liabilities stemming from customer data breaches. This could involve defending against lawsuits, settlements, and regulatory fines imposed for non-compliance with data protection regulations.

To obtain cyber insurance, organizations must often demonstrate specific standards for securing customer data using or mandated identity and access management practices and safeguards.

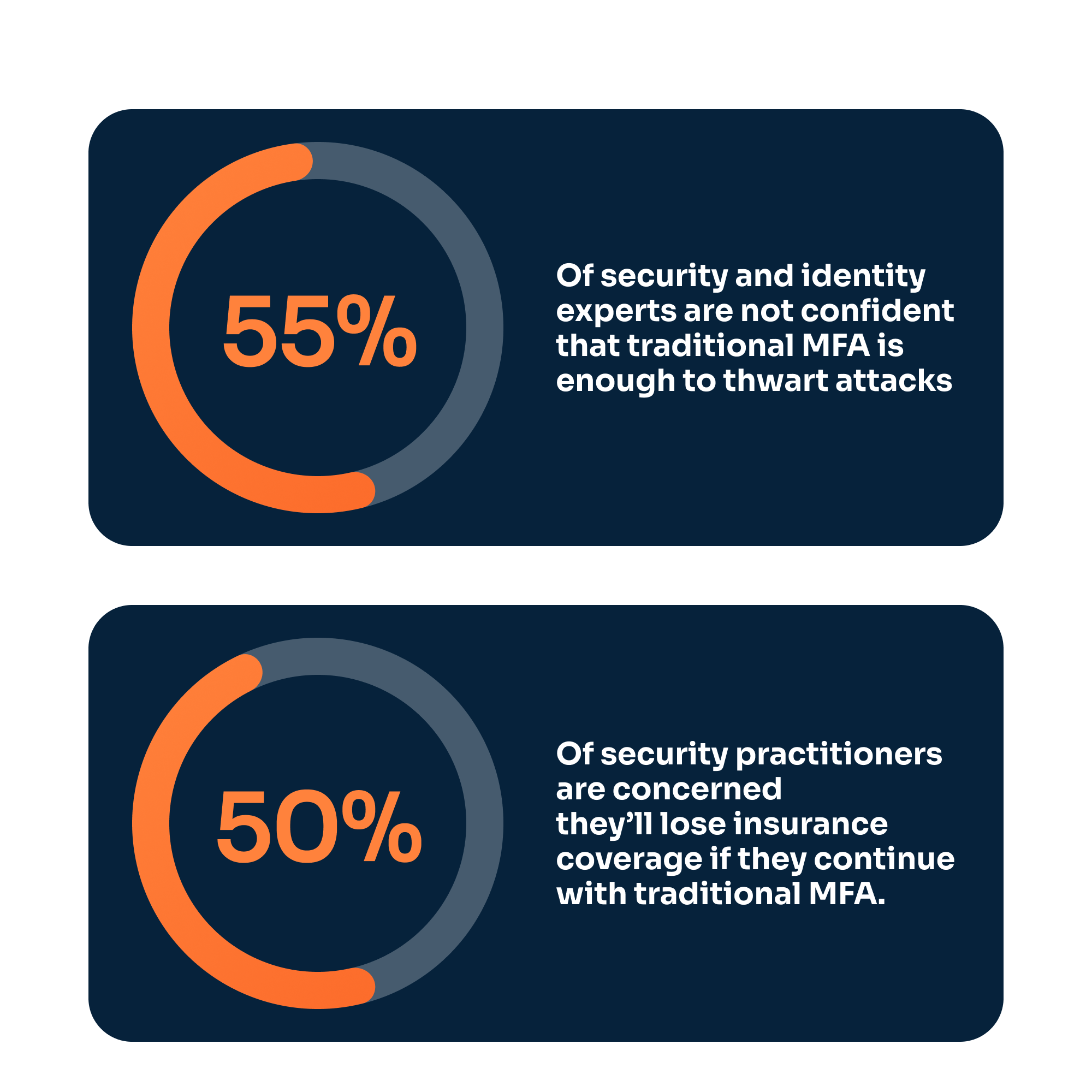

Traditional MFA methods and passwords are often considered insufficient protections for safeguarding customer data by insurers.

Your company may face higher premiums or non-renewals for cyber insurance policies if you are using these outdated methods with your customers.

Traditional vs. Invisible MFA

Cyber insurers are looking for more than traditional MFA to issue policies to protect your company from liability related to customer data breaches:

Traditional MFA

- Only provides “point-in-time” context, no control before authentication or post authorization

- Adds friction with an MFA prompt every time for every authentication

- Uses easy to hack methods like push-to-text or push-to-email

Invisible MFA

- Provides seamless user context throughout the digital journey

- Reduces friction by only requiring prompts when risks appear

- Uses advanced MFA methods like behavioral and passwordless

Nine of the top 10 cyber insurance agencies require or recommend passwordless authentication in order to provide the best policies and rates to companies.

When you provide your customers passwordless continuous authentication based on FIDO2 standards, insurers are more likely to offer you:

- The strongest coverage

- The lowest premiums

- No coverage exclusions

Is your organization prepared?

When applying for cyber insurance, you must fill out questionnaires about your identity and access management practices in place for customer-facing apps and portals.

- Can you specify the MFA methods that you utilize? Are you using push to text and other non-secure methods?

- Do you use real-time risk scoring to continually authenticate users and accounts?

- Can you secure customers post-authorization?

- Do you utilize device trust for a more comprehensive security approach?

- What is your MFA adoption rate? Are you getting push-back from users due to MFA fatigue (i.e., too many prompts)?

- Are you using MFA methods that bypass password usage?

Cyber insurance protects your company against the financial and operational consequences of a customer data breach:

- Financial Protection: Insurance can help cover costs associated with a data breach, including forensic investigations to determine the cause and scope of the breach, notification costs to inform affected customers, credit monitoring services for impacted individuals, and legal fees for defending against lawsuits or regulatory fines.

- Business Interruption Coverage: Many cyber insurance policies include coverage for business interruption expenses. This helps compensate for lost income and extra expenses incurred while operations are disrupted due to a data breach.

- Legal and Regulatory Support: Cyber insurance provides coverage for legal liabilities arising from a data breach, such as defense costs, settlements, and damages awarded in lawsuits. It also helps cover regulatory fines and penalties imposed for non-compliance with data protection laws..

- Reputation Management: Data breaches can damage a company’s reputation and erode customer trust. Cyber insurance often includes coverage for public relations and crisis management expenses to help mitigate reputational harm and restore customer confidence.